Localities expecting more tax dollars due to the elimination of the controversial order acceptance test may be sorely disappointed. Application of the final sales tax sourcing regulations, effective as of June 25, 2014 (see 38 Ill. Reg. 14292), may actually increase the number of sales that are sourced outside of the state, such that more sales are subject to the 6.25 percent Use Tax rate instead of the higher Retailers’ Occupation Tax rates that include additional local rates.

Background: Moving from a Test Favoring In-State Sourcing to a Neutral Approach

In previous posts we provided the background on the litigation and policy factors driving this new regulation. See Illinois Department of Revenue Intends to Extend Its Multifactor Post-Hartney Sourcing Regulations to Interstate Transactions; Illinois Regional Transportation Authority Suffers A Setback In Its Sales Tax Sourcing Litigation. Suffice it to say that Illinois sales tax sourcing has been a contentious issue. But Illinois local government units may now find that the revenue impact of these new regulations is worse that the sourcing issues that they attempt to cure: Where the previous regime had tended to source sales to Illinois if part of the retailing activity occurred in the state, the new regulations treat in-state and out-of-state locations equally and attempt to source sales to the location with the best claim on the retailing activity.

Step One: Can a Location Claim at Least Three of Five Primary Selling Activities?

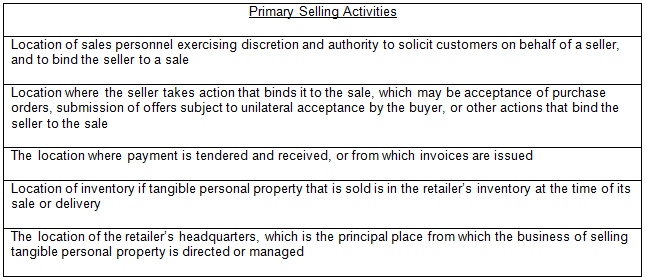

The first part of the test looks to five primary selling activities. If at least three of the primary selling activities occur in one business location, then the sales are sourced to that location. See 86 Ill. Admin. Code 220.115(c)(1), (2). (Note: These sourcing regulations are codified in parallel under several chapters of the Illinois Administrative Code. See 86 Ill. Admin. Code 220.115, 270.115, 320.115, 370.115, 395,115, 630.120, 670.115, 690.115, 693.115, 695.115. For convenience we will cite to 86 Ill. Admin. Code 220.115, but parallel provisions exist in the other regulations.) The primary activity factors are as follows:

Broadly speaking, the primary selling activities would likely result in headquarters-based sourcing as long as the business has a centralized headquarters with personnel that have the authority to bind the seller and personnel issuing invoices and processing payments. Additionally, there appears to be an overlap between the first two activities: If salespersons have authority to bind the retailer to a sale, then it would seem that the second factor, where the binding action takes place, would also be implicated.

Step Two: If No Location Has a Majority of Primary Selling Activities, then the Headquarters and Inventory Locations Compete for Sourcing Based on Primary and Secondary Factors

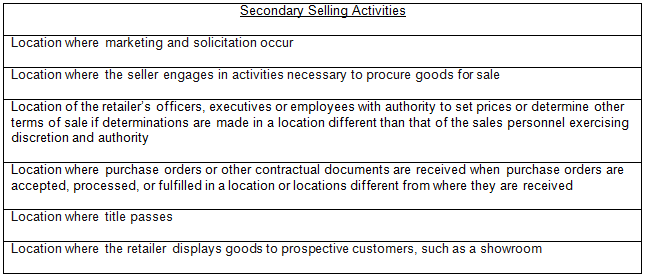

Assuming that no single location can claim three primary selling activities, the test then turns to the second step, in which both primary and secondary selling activities are considered in determining whether the sales should be sourced to the headquarters location or the inventory location. See 86 Ill. Admin. Code 220.115(c)(4), (5). The secondary selling activities broaden the analysis to include almost all aspects of the retailing operation. Bear in mind, however, that this is not a free-for-all; only the jurisdiction where the inventory is located or the headquarters is located is eligible for sourcing at this point. However, if step two does not yield a clear answer the retailer is presumed to be engaged in the business of selling at the location of its headquarters absent clear and convincing evidence to the contrary.

Special Rules Can Raise More Confusion

In addition to the general two-step sourcing test, there are various special rules for sourcing certain types of transactions. See 86 Ill. Admin. Code 220.115(d). Of particular concern is section (d)(2) of the regulations, which cites Chemed Corp. v. Illinois, 542 N.E.2d 492 (Ill. App. 4th Dist. 1989), for a presumption that:

If a retailer’s selling activities take place in taxing jurisdictions outside this State, except that the tangible personal property that is sold in an inventory in the possession of the retailer located within a jurisdiction in Illinois at the time or its sale (or is subsequently produced by the retailer in the jurisdiction), then delivered in Illinois to the purchaser, the jurisdiction where the property is located at the time of the sale or when it is subsequently produced by the retailer will determine where the retailer is engaged in business with respect to that sale.

The Chemed decision, however, may be inconsistent with the new regulatory scheme weighing in-state and out-of-state operations equally. Paragraph (b)(7) of the regulations says that “the legal standard is the same” for interstate and intrastate sourcing, citing, among other cases, Hartney Fuel Oil Co. v. Hamer, 2013 IL 115130 at ¶ 30. Hartney may have superseded Chemed or relegated Chemed and paragraph (d)(2) into a tiebreaker that applies only if the two-step multifactor test results in a draw.

Revenue Impact: Will the Cure Be Worse than the Problem?

Under the new regulations, it is easy to envision more retailers sourcing their sales outside Illinois. Those companies headquartered outside of the state could easily determine that they are required to situs their taxable retailing activity outside of the state, even if they have a substantial distribution center or other facility in an Illinois jurisdiction. The revenue loss to that jurisdiction could be substantial, and particularly so if additional home rule Retailers’ Occupation Taxes had previously resulted in a Retailers’ Occupation Tax rate in excess of the 6.25 percent base rate.