Since the Tax Cuts and Jobs Act (TCJA) passed in December 2017, over 100 bills were proposed by state legislatures responding to the federal legislation. Thus far in 2018, nearly half of states have passed legislation responding to the TCJA. With some exceptions, in this year’s legislative cycles the state legislatures were primarily focused on the treatment of foreign earnings deemed repatriated and included in federal income under IRC § 965 (965 Income).

The STAR Partnership has been very involved in helping the business community navigate the state legislative, executive and regulatory reaction to federal tax reform, and IRC § 965 in particular. The STAR Partnership’s message to states has been clear: decouple from IRC § 965 or provide a 100 percent deduction for 965 income. The STAR Partnership emphasized that excluding 965 Income from the state tax base is consistent with historic state tax policy of not taxing worldwide income and avoids significant apportionment complexity and constitutional issues.

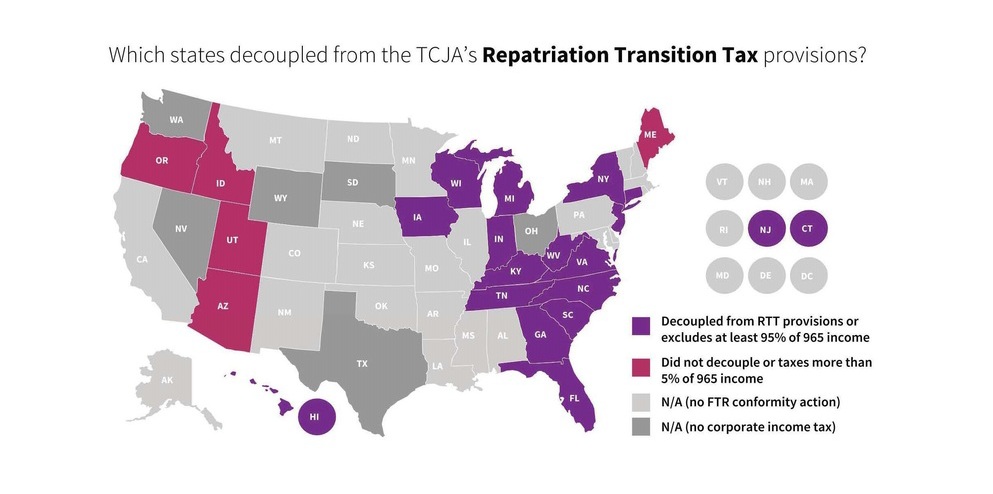

Most of the states that enacted legislation in response to the TCJA ultimately conformed to the recommendation of the STAR Partnership and did not tax a material portion of 965 Income. Of the states that enacted legislation in response to the TCJA, only one state explicitly decided to tax more than 20 percent of 965 Income. Below is a map prepared by the STAR Partnership illustrating the states’ responses to IRC § 965.

2018 STAR Partnership Success Stories Related to IRC § 965

Connecticut: Connecticut provides a dividends-received deduction for deemed dividends that, based on guidance from the Connecticut Department of Revenue Services, applies to 965 Income. A bill proposed by the Connecticut legislature would have deemed 10 percent of the dividend income to be a non-deductible expense attributable to such income. Due, in part, to advocacy efforts of the STAR Partnership and its members, the legislation that was ultimately adopted contained an expense attribution percentage of only 5 percent.

Hawaii: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support Hawaii’s decoupling from IRC § 965. When legislation was passed, Hawaii did decouple from IRC § 965.

Indiana: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support Indiana’s exclusion of 965 Income from the tax base. Indiana did enact legislation providing a 100 percent deduction for 965 Income, provided the taxpayer owns at least 80 percent of the foreign subsidiary.

Iowa: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support Indiana’s decoupling from IRC § 965. Iowa did enact legislation effectively decoupling from IRC § 965.

Kentucky: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support Kentucky’s decoupling from IRC § 965. Kentucky did enact legislation effectively decoupling from IRC § 965, at least with respect to taxpayers with calendar year CFCs.

Missouri: The STAR Partnership requested guidance from the Missouri Department of Revenue providing that 965 Income will be treated as a dividend and excluded from the state tax base under Missouri’s law, regardless of whether the taxpayer uses a three-factor or single-factor apportionment formula. The Department of Revenue issued the guidance that the STAR Partnership requested and, thus, pursuant to that guidance 965 Income is excluded from the Missouri state tax base for corporate taxpayers.

New Jersey: The New Jersey legislature proposed a special dividends tax on 965 Income, which would have resulted in tax being imposed on approximately 3 percent of total 965 Income. The STAR Partnership prepared talking points in opposition to the “special dividends tax” and sent a letter to the New Jersey legislature explaining that such tax was unconstitutional. Due to these efforts and the efforts of the STAR Partnership members, the legislature did not adopt the “special dividends tax.”

North Carolina: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support North Carolina’s decoupling from IRC § 965. The legislature ultimately enacted legislation providing a 100 percent deduction for 965 Income.

Oklahoma: Due in part to the advocacy efforts of the STAR Partnership, the Oklahoma Tax Commission has stated that it will issue regulations that would effectively exclude 965 Income from the Oklahoma apportionable tax base for most taxpayers.

South Carolina: The STAR Partnership prepared policy and technical talking points and worked with local advocates to support South Carolina’s decoupling from IRC § 965. The legislature did pass a statute decoupling from IRC § 965.